Tds deduction on salary calculation

1 Calculate gross monthly income as a sum of basic income allowances and perquisites. Section 192 of Income-tax Act puts an obligation on employer to deduct tax at the time of making payment of salary to employeeThis video will show you how t.

Communication Of Proposed Adjustment U S 143 1 A Communication Taxact Adjustable

Consider tax treaties before determining the rate of withholding tax under Section 195.

. There is no tax. They first calculate the entire money you are earning in a year. Average Rate of Tax on Salary Total Tax 100Total Income How to use the TDS calculator.

TDS on Salary Calculator Calculation of TDS on Salary Tax Deduction at SourceIn this video by FinCalC TV we will see how to calculate TDS on salary on mo. As per Section 192 of the Income Tax Act 1961 TDS is deductible on salary income. Note your monthly income and multiply it by 12 to find your yearly income.

Total Salary earned during FY 2019. TDS on the salary received from multiple. The process of TDS deduction on salary is a rather detailed one that may be enumerated as below.

Depending on your net taxable salary the TDS is deducted by the employer on your behalf and deposited. This can be done by adding monthly basic income perquisites. The rate of TDS deduction on salary is determined by amount of income you get from your employer which determines which tax bracket you belong into.

Step 1 Find out the gross monthly income. Total TDS to be deducted. TDS that needed to be mainly deducted by the employer at the time of payment of salary when income which is considered as taxable ie Gross Total Income fewer Deductions.

2 Calculate exemptions under. Next the TDS rate on salary is calculated by dividing this tax amount by the gross salary which is 1025001400000 x 100 728. One can calculate TDS on income by following the below steps.

TDS has to be deducted on the estimated income of employee at the average rate of Income-tax computed on the basis of rates in force for that financial year. TDS full form -Tax Deducted at Source is simply tax levied on the income and deducted at the source level. This will usually be equal to your CTC.

Here are six easy steps for you to calculate the TDS on salary. Section 192 of the Income Tax Act 1961 provides for TDS on salary income earned by an employee and paid by an employer. Every salaried employee has to pay tax.

So while computing the TDS to be deducted from the salary paid to such employer under section 192 the following shall be done. Salary income is charged at slab rate and TDS is deducted by calculating average rate. The employer deducts tax deducted at source while.

Secondary and higher education cess. Here are the steps thatll help to calculate TDS on salary. What is TDS on Salary.

Income Tax Calculator Python Income Tax Income Tax

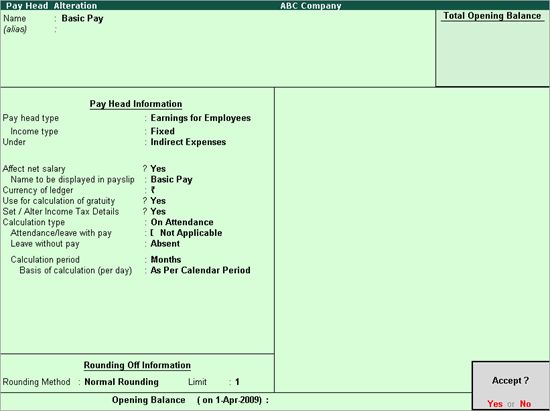

Creating Earnings Pay Head Payroll In Tally Erp 9 Voucher Tutorial Data Migration

Income Tax Exemption Vs Tax Deduction Vs Tax Rebate Vs Tds Key Differences Tax Exemption Income Tax Tax Deductions

Prealgebra Activities Real Number System Maze Activities The First Unit Of The Year Is Always The Mo Real Number System Real Numbers Pre Algebra Activities

Although E Filing Of Tcs Return Is Not So Complicated To A Person Who Have Some Know How About The Taxation And Efiling But If Yo Return Learning Complicated

Sms Alerts For Tds Deduction From Income Tax Department Income Tax Income Tax Return Deduction

Checklist Of Documents For Filing Income Tax Return Tax Checklist Income Tax Accounting Training

Tds On Sale Of Immovable Property Section 194 Ia Form 26qb Tax Deducted At Source Sale Property

File Manager In Eztax In App Filing Taxes Income Tax Self

Tds In Tally Prime Tds Entry In Tally Prime Tds In Tally Erp 9 Tds In Tally Development Entry Power

How To Enter Receipt Voucher In Tally Erp 9 Tally Erp 9 Tutorials

Ay 2021 22 Different Types Of Itr Forms Different Types Type Form

Pf Deduction Pay Head For Employees Payroll In Tally Erp 9 Data Migration Deduction Data

Payroll Hr Ppt Slides Powerpoint Templates Powerpoint Hr Management

Cleartax 39 S Guide To Tax Implications On Capital Gains From Sale Of Shares House Property Filing Taxes Tax Refund Income Tax Return

Download Salary Sheet With Attendance Register In Single Excel Template Exceldatapro Attendance Register Salary Attendance

Download Employee Turnover Cost Calculator Excel Template Exceldatapro Employee Turnover Payroll Template Turnovers